The Wright Research portfolio look extremely attractive when you look at our smallcase pages. Our Balanced MFT portfolio has given a 95% return in almost 2 years of being live and our Momentum portfolio has given 65% return in its live journey of 7 months. But there is a churn every month, you pay a transaction fee for that and what about tax? In this post we try to answer some key questions related to the actual cost of investing with us.

The costs of trading

Whenever you make a transaction in the equity markets, you incur a cost. You pay the broker, the depository, the stamp duty and the tax man. While these costs are minor and add up to ~ 10-20 basis points or 0.1% to 0.2% of the transaction value, over time these costs add up. Here's a infographic detailing the various costs of stock trading.

Capital Gain Tax

When we talk about capital gain tax, you will be paying the short term capital gain tax based on the profit gained with these portfolios. We typically churn our stocks in 1-6 months and one has to pay a short term capital gain tax (15% on profit) when you hold securities for less than a year.

Post Cost Performance

If we take into account these costs, the PNL of our portfolios shifts down a little bit. If we use the Zerodha brokerage the series of the Balanced Multi Factor and Momentum look something like this. The balanced multi factor portfolio has a profit percentage lower by 2.5% per year due to cost (this is for a portfolio of recommended size 2-5 lac). The momentum portfolio also has a similar decrease in PNL per year ~3%.

Pre and post cost performance of Balanced MFT

Pre and post cost performance of Momentum

Margin based capital calls

There was a change in exchange rules for the margin release post sell transactions recently. Now when you sell a share only 80% of the margin is released and rest is released on T+2 basis. Therefore the amount you sell might not be good to buy the stocks recommended on the same day, it will come to your account in a couple of days.

Due to this you might be notified by smallcase to add a certain amount to proceed. You will also see an option to proceed anyways, where you can buy only the shares worth the sell margin released and when the come back in 2 days and buy the rest of the stocks without adding any additional capital.

Rebalancing & Reinvestment

We periodically change the minimum investment size and try to keep it low. One drawback of keeping the sizes low is that in a 20 stock portfolio you cannot have stocks with prices more than say 2000. Also when we decrease the portfolio minimum investment amount, you profits are realised and not reinvested. To reinvest the profits you might have to increase you investment by SIP or via lump sum increases.

Timing SIP and new investments

We rebalance usually at the beginning of the month. So it is best to invest towards the beginning of the month and time your SIPs and additional investments towards the beginning of the month. Some people like to time their investments when the market dips but that would require a much active monitoring of the markets which is not possible for everyone.

Wright Portfolio Tracker

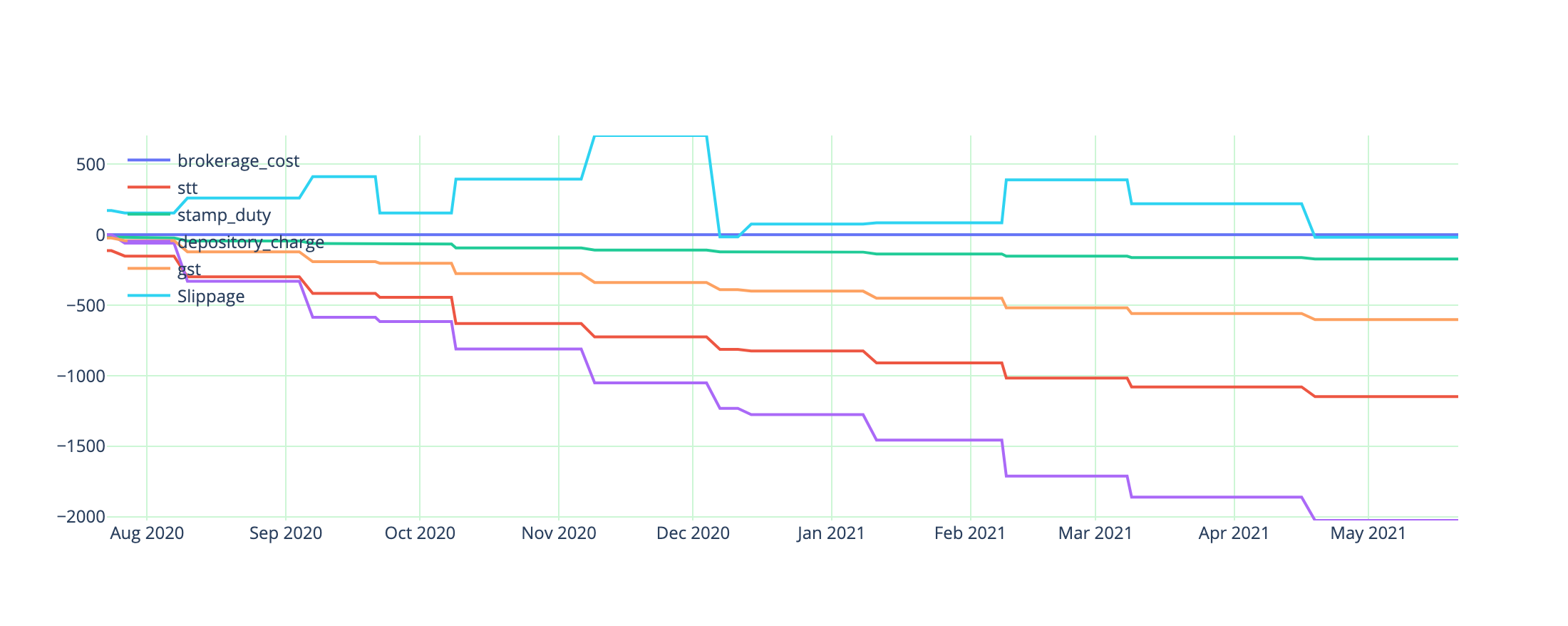

Did you know that we have a nifty little portfolio tracker on the Wright Research website to track performance post cost? You can find it here. One of my friends Srinivasa who's a product manager from Bangalore subscribed to our Balanced MFT portfolio last year and was confused on the costs being incurred and the calls for adding capital into his account on rebalancing day. We put his Zerodha tradebook into our tracker tool and here's his PNL and costs. We can see that his costs have taken away around 4k away from the ~80k profit that his portfolio has generated since August 2020.

PNL

Costs